“Digital transformation is more an issue of change management, and there are still efforts to be made in convincing people to work differently.”

Laurent Denayer is the CEO of ume, winners of ‘Fintech Startup of the Year’ at the Luxembourg Finance Innovation Summit 2017. ume will be taking part in the 2018 edition of Fintech Europe, a unique investment readiness program created by Village Capital in conjunction with PayPal, Middlegame Ventures and the LHoFT.

The program will be held in Berlin, April 16 -19, and Luxembourg May 14 – 17 & June 11 – 14. The program will provide three months of venture development training for 12 fintech and regtech entrepreneurs creating financial health and compliance solutions for the EU. The ventures are all backable, and represent a high degree of both innovation and disruptive impact potential in the financial space. Up to two companies will be eligible for funding of up to € 200,000 from MiddleGame Ventures.

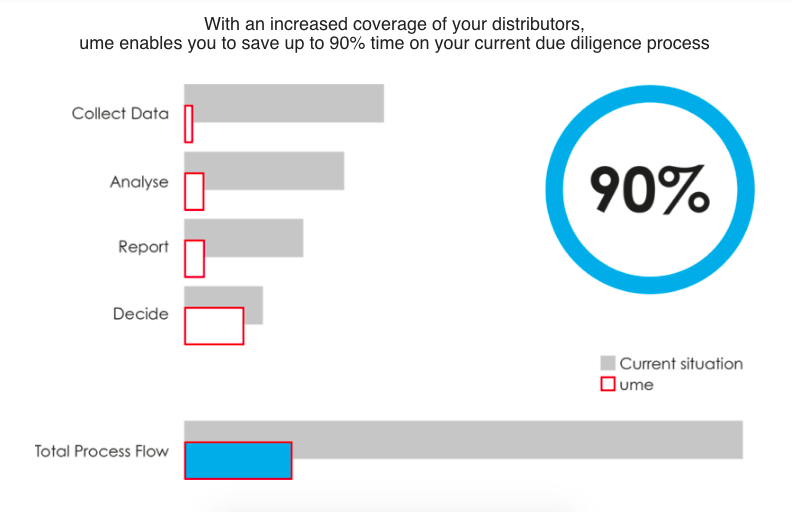

ume automates and optimises the due diligence of fund distributors by mutualising data and information. The data collected enables Fund Management Companies to score, compare and select fund distributors – Applying the ‘Trip Advisor’ approach to fund distribution.

- Location: Luxembourg

- Sector: Digital Identities

- Website: ume.solutions

- Twitter: @ume_kyd

Please introduce yourself, and tell us a little bit about your journey with ume:

ume (‘you-me’) is a startup that was incorporated 13 months ago, in February 2017. ume means ‘destiny’ or ‘dream’ in Japanese. I guess that ume represents ultimately what I would like to achieve in my professional career: the development and successful marketing of an innovative solution that can transform the asset management industry combined with a fun but challenging team experience. I have been working for more than 20 years in the financial industry in portfolio management and providing advisory services in risk management and fund distribution. I never chose the easiest path, had successes and failures, but always learned and progressed.

In about a year with ume, we built our solution (from zero to one) and were able to on-board our first clients in January 2018. We also won the 2017 award of best Fintech startup in Luxembourg, and were selected in a coaching and public aid programme (Fit4Start) from the Ministry of Economy of Luxembourg and Luxinnovation. ume is ranked #39 most influential Regtech in the world by PlanetCompliance.com (as of 10 April).

What is the genesis of ume? Where did the idea originate?

I was an advisory partner and Global Fund Distribution Leader at EY and it was clear to me that the regulatory obligation to oversee delegates, particularly fund distributors, has been significantly increasing in recent years culminating with the implementation of MiFID II. Fund Management Companies are spending a lot of time and efforts collecting and chasing the same information from their distributors of their funds. ume’s idea is to introduce a utility platform between the Management Companies and the distributors to standardise the data collected and to mutualise informations between parties. We believe we can save up to 90% of time spent on the current processes. This mutualisation is best provided to the fund industry by an independent platform that is not conflicted by audit relationship or other type of businesses.

What has been the response from the asset management industry? Are they hungry for innovation and new ideas?

The asset management industry has indeed been very receptive. Transparency that can lead to cost and risk reduction but also to new business development which is a very appealing proposal. With our solution, people can spend time on information analysis and not any more on data collection.

How has being based in Luxembourg influenced your journey?

Luxembourg is the second biggest place for fund domiciliation in the world (after the US) and the largest for cross-border distribution of funds. We have here a concentration of asset management companies that have multiple thousands of distributors in more than 65 countries in the world. The current, predominantly manual, due diligence processes are unsustainable in the heightened regulatory environment. This is for us the best place to have a global footprint.

Laurent Denayer accepting the top prize at the Temenos Multifonds Luxembourg Innovation Jam.

Do you see any value of having the due diligence information you collect stored on a blockchain, or the decisions driven more by AI?

Blockchain and AI are on our roadmap. They are promising technologies that we want to offer in our solution. This being said, I do not think that our biggest challenge is technology. Digital transformation is more an issue of change management, and there are still efforts to be made in convincing people to work differently.

What are you hoping to get out of the Fintech Europe 2018 program?

We hope to learn from the other Fintechs. We are still at an early stage and it is good to understand the issues that others have had and the way they solved them. We want also to learn how investors can help us accelerating our growth and our ambitions.