The global financial crisis of 2007-2008 resulted in a very substantial, and in all likelihood irrevocable, increase in regulatory burden for the financial industry. Cross-border compliance with international, regional and national frameworks is among the most daunting tasks facing large financial institutions.

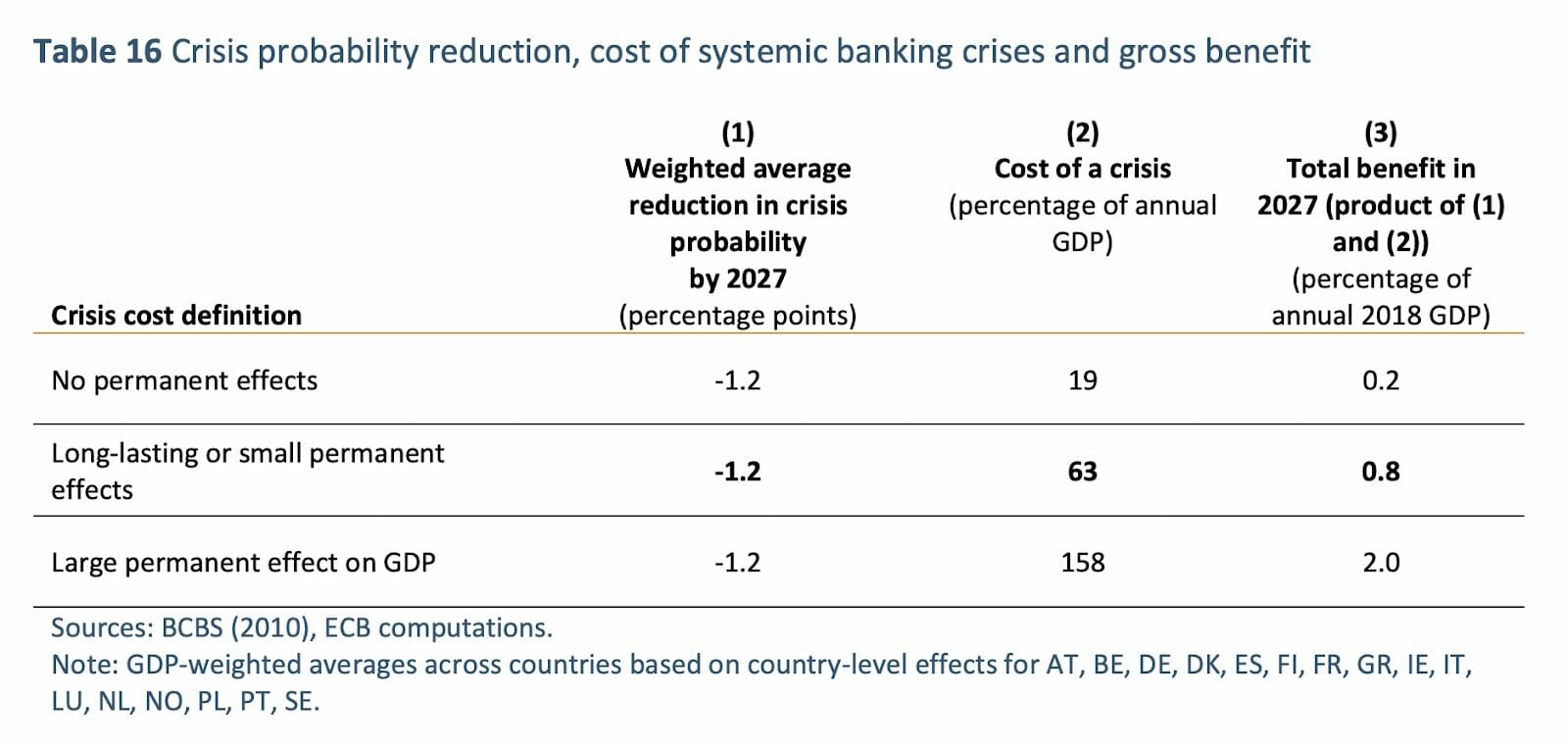

While new bodies of regulation such as the Basel III framework ultimately aim at reducing the risk and costs of financial crises, the real-world costs of their implementation are subject to much debate.

Figure 1: EBA estimates that full implementation of the Basel III reforms will reduce the likelihood of additional financial crises by 1.2%, translating into potential GDP impacts ranging from mild to significant.

Today we are going through another crisis, one that in many ways is far more profound than the global financial crisis as its roots lie not in finance but in a pandemic that is reshaping the underlying social substrate of our economies.

However, with the advent of a new conundrum, old ones don’t disappear, and the burden imposed on financial institutions by regulatory compliance will only become compounded by emerging macro trends such as a shortfall in corporate sector liquidity due to synchronized drop in demand. Greater resilience is the plat de résistance on every financial institution’s operational menu as we navigate this crisis together.

All things regulatory remaining equal – with the exception of temporary emergency exemptions – technology is the most promising variable in which banks and other market participants can invest in order to deal more efficiently with the complexity they face.

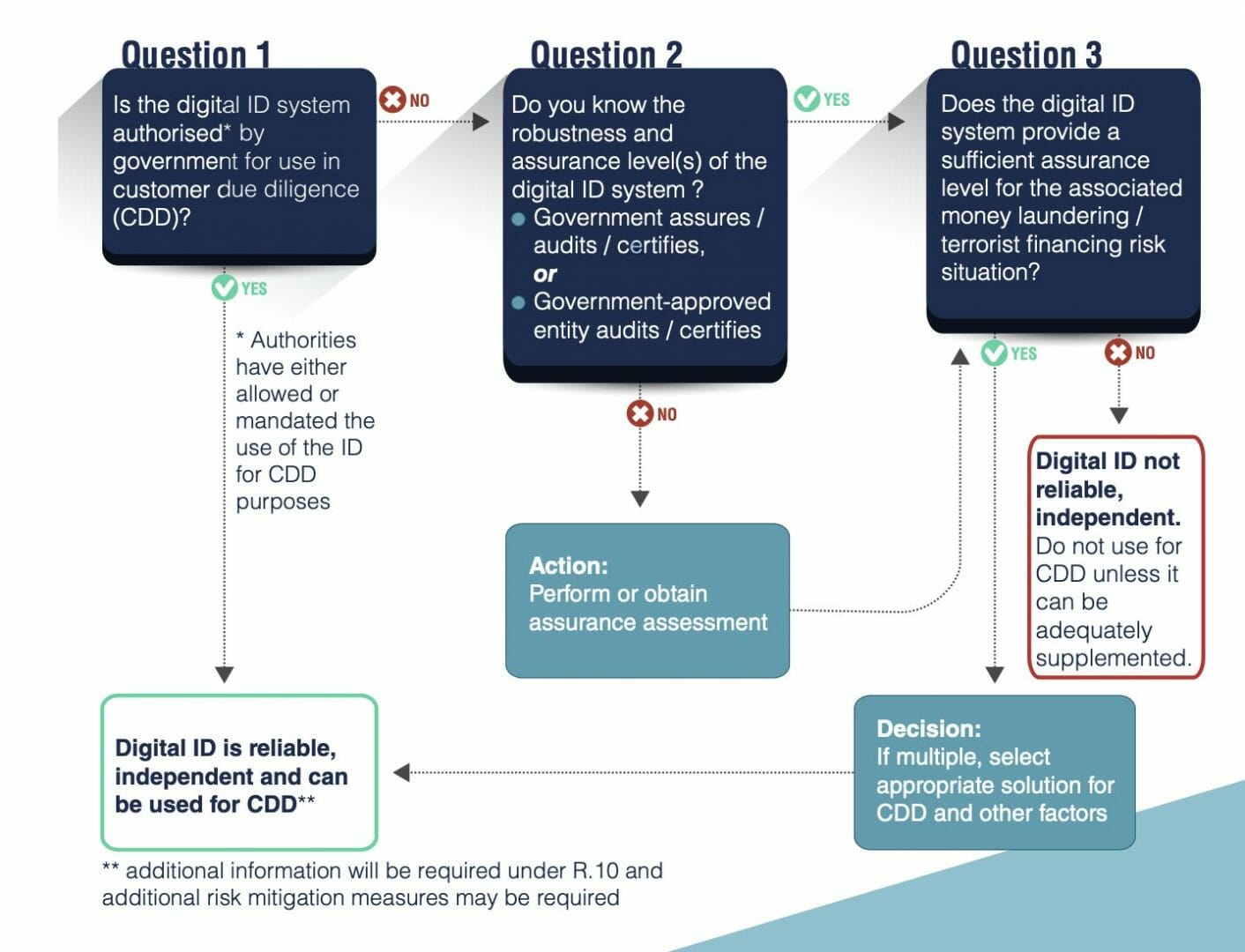

There are several angles to be explored here, from organizational buy-in over data strategy and digital identity and the legally sensitive nature of technological black boxes. Financial fraud is unfortunately on the rise as a result of the current crisis and together with globally rising volumes of digital transactions, requires more efficient supervision.

Figure 2: FATF flow chart on digital identity suitability for customer due diligence

It is unrealistic, and economically undesirable, to believe that the surge in digital transactions can be effectively supervised with existing processes and a surge in manpower alone. At the end of the day, RegTech is about improving processes, in turn improving operational efficiencies, freeing up human capital for higher value-added tasks and thus strengthening oversight. The potential for technology-driven transformation of the compliance function is not lost on regulators either, with the prospect of embedded supervision becoming increasingly realistic.

As an interview with Bert Boerman of governance.com, a LHoFT member, lays bare, market interest in RegTech is on the rise, yet much more needs to be done in order to accelerate the technological transformation of regulatory compliance. Crucially, organizational buy-in must be present for meaningful change to occur.

Technology is not a panacea, yet technological transformation is very much in the hands of any given institution – in stark contrast to external factors such as global regulatory trends or a health crisis and its economic aftershocks. At LHoFT, it is “in our DNA” to bring together emerging innovators and established firms with a view on accelerating necessary change.

Author: Jérôme Verony – LHoFT Research and Strategy Associate