The global payment landscape remains complex and fragmented all the while significant changes are in the process of materializing. Both on the legislative & regulatory side of things as well as on the technological & commercial front, significant efforts are underway to shift the paradigm.

Let’s begin with a few high-level considerations.

Payment systems impact economic activity and monetary considerations

The promotion of frictionless, low-cost and secure payments has unequivocal benefits to consumers, merchants and ultimately the financial market infrastructure providers enabling such transactions. While customer experience – e.g. via ease of payment, trust in a payment solution, incorporation into automated financial planning – is of paramount importance to the commercial adoption of any given payment solution, the promotion of new paradigms also has impacts on monetary policy and financial stability considerations.

A 2011 speech by Dimitar Bogov, then Governor of the National Bank of Macedonia and now regional lead economist for Eastern Europe and Caucasus at the European Bank for Reconstruction and Development, linked the modernization of payment systems to an increase in the velocity of money:

“Velocity of money circulation is endogenously determined by the economic agents’ decisions regarding liquidity holding, lending, borrowing, investing, consumption and labour. Yet an increase in the efficiency of payment systems increases the velocity of money circulation exogenously. From a monetary policy point of view it becomes important to estimate the quantitative and qualitative impact of this exogenous change. “

Velocity of money has in turn been linked to economic growth & inflation and is an important consideration for monetary policy.

Fast forward by a decade, and the question of payment system interaction with monetary policy and global financial stability has been revived by the emergence of “stablecoins” not least due to the high-profile Libra project. Recently, the FSB provided a comprehensive, initial consultation document addressing the oversight challenges raised by (hypothetical) global stablecoins, acknowledging that “So-called “stablecoins”, like other crypto-assets, have the potential to enhance the efficiency of the provision of financial services, but may also generate risks to financial stability. The activities associated with “global stablecoins” and the risks they may pose can span across banking, payments and securities/investment regulatory regimes both within jurisdictions and across borders.”

At the heart of the issue is that while the notion of a stablecoin is relatively straightforward at its core – cryptocurrencies designed to minimize volatility with regard to the coin’s value – there are several potential means by which this goal of value stabilization can be achieved, and together with the ultimate purpose of a stablecoin, typically as a means of payment, their architecture creates a spectrum of risk profiles that need to be assessed before any major jurisdiction will provide buy-in. For a summary discussion of these considerations, I would refer readers to Fnality’s initial public response to the FSB consultation document.

Policy matters as much as technological (r)evolution

Just as new technologies prompt regulatory examination, legislative and regulatory action can act as significant catalysts to the evolution of the payments industry.

A timely WEF post discusses 4 key steps to support cross-border payments and growth in digital trade, namely:

- Modernization of trade agreements to remove market barriers for payment services, citing the recently concluded USMCA and its extension of national treatment and protection of data flows across signatories;

- Promotion of interoperability via internationally accepted standards, which in turn can be promoted by specific provisions in trade agreements;

- Ensuring security and trust in the payment system, citing the need for public-private partnerships notably on matters of cybersecurity;

- Coordinated regulatory oversight in order to enable cross-border innovation.

The WEF authors drive home the need for progress on all of these fronts given that “Facilitating cross-border retail payments today is complicated, requiring connections between a complex set of banks, applications, domestic and international payment service providers and, of course, consumers and merchants. But, these payments are also more important than ever given the urgent need for inclusive growth and competition in the global economy. Ever-changing technological innovation means that the role of payments will only grow and change with shifting needs and priorities.”

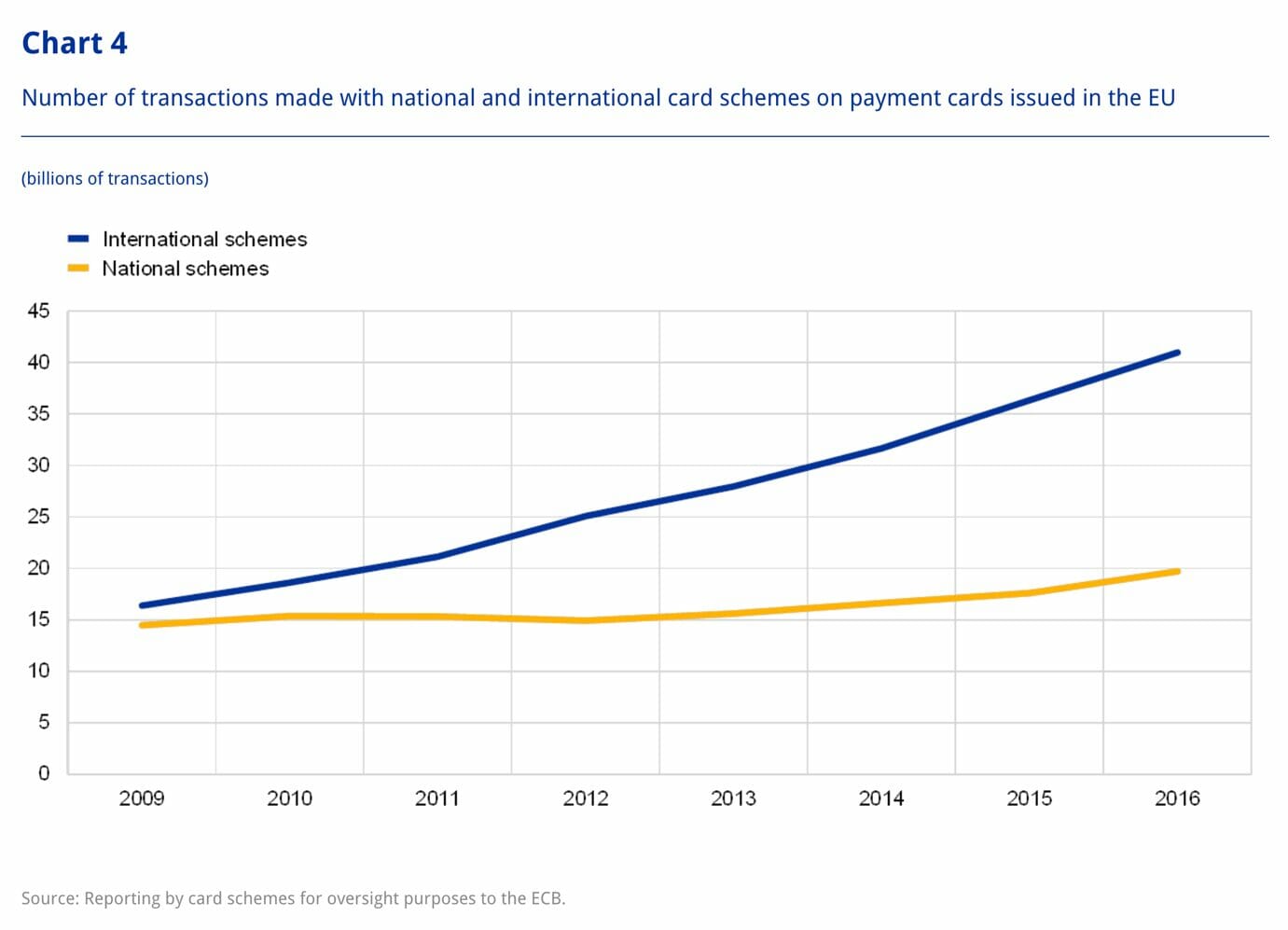

Consider just how significant growth in card transactions has been within the EU over the past decade, but also how much more significant the growth in volumes has been for international schemes vs national schemes:

Source: Eurosystem report

The dominance of international card schemes is a testament for the ever-more significant demand for globally compatible payment systems, but it also underlines the need for alternatives.

As the ECB discusses, in the specific context of card schemes, but with broader relevance to the payment market as a whole: “Bringing national card schemes into cross-border acquiring might also increase the number of competitive players in an inherently oligopolistic market. Increasing cross-border reachability could further increase competition in processing and acquiring services, which tend to be fragmented along national lines. Finally, increased competition and market consolidation could help the market along the path of product and process standardisation and support investment in innovation.”

One way that payment system innovation and competition has been encouraged in the EU is via the SCT Inst scheme which enables credit transfers within the SEPA area in less than ten seconds. Launched in 2017, this initiative is only beginning to bear fruit given the resource intensive nature of its implementation, but its backers have remained confident that a critical mass will be reached by late 2020. As of late 2019, half of SCT adherents within the SEPA area had signed up & indicated reachability under SCT Inst, and 32 clearing and settlement organisations had disclosed their intention to become SCT Inst compliant.

Will SCT Inst radically transform the marketplace? Realistically, the payments marketplace will remain complex and in flux, and regardless of SCT Inst’s, or any other initiative’s potential future market share and use cases, the drive towards more efficiency in the service of the real economy and ultimately the customer is a welcome one.

Collaborate to succeed

Against this multifactorial & evolving backdrop for the payments space, incoming COO at LHoFT member Payconiq underlined what is likely the key determinant of progress going forward: collaboration. As Stijn Van Brussel explains in a recent interview, the emergence of global payment schemes has led to a relative loss of control by European authorities and market participants over the vital payment rails which “at the end of the day are the oil greasing the economy’s engine”. Initiatives such as SCT Inst signal a willingness to regain influence and market share all the while embracing a customer-centric user experience. To bring it all together – market access, regulatory compliance, customer trust & cybersecurity – collaboration with established market participants will remain key to Payconiq’s business strategy: “the future of payments is also shaped by regulation. In Europe, we have very advanced regulation in terms of open banking, which has completely changed the rules of the game for banks. Actually, we think this is one of our key roles: to help banks stay relevant in an increasingly competitive environment. This is why we’ve been working hard on embedding our solution in bank apps.”

Leveraging comparative advantages – intellectual property in relation to technological breakthroughs, established market infrastructure, regulatory affairs experience – will remain a key consideration for the future viability of any and all market participants in the payments space, be they small or large. LHoFT exists to enable such collaboration, which is facilitated by the all-hands-on-deck approach of our private and public partners in Luxembourg.

Author: Jérôme Verony – LHoFT Research and Strategy Associate