“Problems that seemed insurmountable just a few years ago, like cost effective last-mile services, are now solvable. But we continue to see a gap between access to financial services and usage of financial services.”

At the LHoFT, we strongly believe that financial technology is crucial to advancing financial inclusion, empowering groups that have been left behind by the traditional financial system. Whether it’s financing for rural farmers, point of sale technology for underbanked merchants, or specialised insurance products, the positive impact being driven by entrepreneurship is improving lives around the world.

In the run up to our Financial Inclusion program, Catapult: Inclusion Africa, we will be sharing insight from key figures in the Financial Inclusion world. This time we spoke to Camilla Nestor, CEO of MIX:

Camilla Nestor, CEO of MIX

Can you tell us a little about yourself and your company?

I’ve spent 20 years focused on financial services and investing in emerging markets, working directly with local financial institutions and more recently leading Grameen Foundation’s impact investing unit. While at Grameen Foundation, I expanded the investment portfolio to new sectors including digital technology and agriculture. The perennial challenge for investors moving into new sectors is having the necessary information to make decisions including how to allocate capital for the greatest impact.

That challenge is what inspired me to join MIX, an organization with a track record of solving information problems in financial inclusion. Over the past year, we’ve spoken with investors and funders who stress the need for open data and information flows, especially in new sectors. There is a growing variety of business models for providing financial services to poor people, including fintechs, pay-as-you-go energy providers, and agricultural equipment leasing companies. With this in mind, MIX is developing information solutions like data standards, common vocabularies and shared performance metrics. I’m excited because these efforts will help improve the flow of capital to the companies and people that need it.

As someone who has been involved in Financial Inclusion since the mid-90s, how have you seen the sector evolve up until today?

There have been a couple of major pivot points. First was the realization that low-income households are extremely active money managers; in fact, they’re much more active than you and I. The groundbreaking financial diaries approach showed that they require a range of financial tools beyond credit to manage their lives.

Second, and this should come as no surprise, technology has completely changed the operating environment. Problems that seemed insurmountable just a few years ago, like cost effective last-mile services, are now solvable. But we continue to see a gap between access to financial services and usage of financial services. This presents a huge opportunity for fintechs to develop products that people want to use. We’ve seen a number of digital credit products but I’d like to see more innovations that make it easy for people to save and build assets.

Have any technological developments produced inflection points in the progress toward total inclusion? Are there any you see coming in future?

The first major transformation was the idea that your wallet and phone could be one and the same. Now, there is tremendous opportunity to leverage alternative data sources to unlock financial services for the unbanked, especially with the rise of ‘super platforms’ like Ant Financial and Facebook. It’s difficult to predict the future in a disruptive environment like this, but they have the potential to dominate financial services.

But these new technologies, data sources and algorithms open up new risks that we must manage, especially around data privacy and consumer protection. I’m glad to see several regulators developing ‘sandboxes’ to test financial innovations while also taking care to protect consumers.

MIX platforms cover thousands of financial institutions, impact investor portfolios, agri-businesses, mobile money providers and other actors in global developing markets. What are the notable differences between Africa and other regions that can be gleaned from that data?

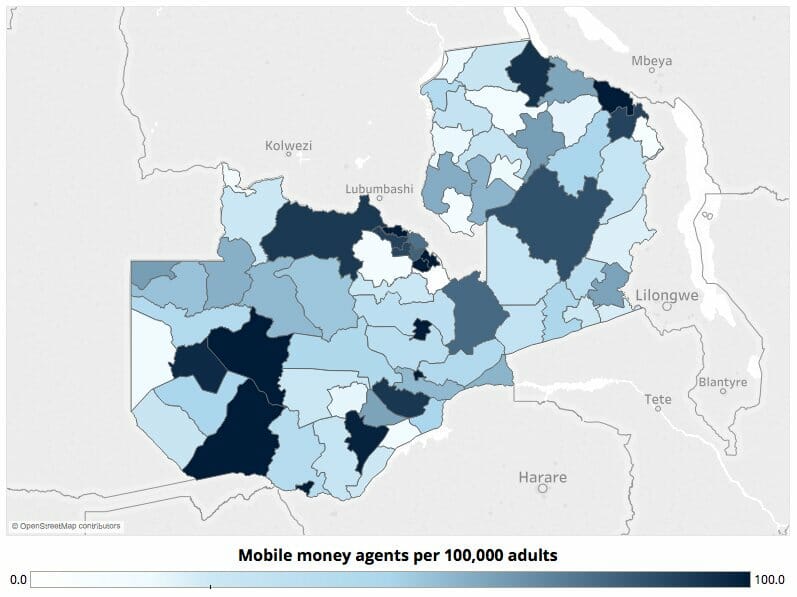

The major difference between Africa and the rest of the world is the leading role mobile network operators have played in driving financial inclusion. Before the launch of M-Pesa in Kenya, outreach by banks and microfinance institutions to low-income households was marginal and growing very slowly. Mobile money changed the landscape completely and within a few years several markets had more mobile money accounts than bank accounts.

Having overseen Financial Inclusion investment and nonprofit activity around the world, what are your personal thoughts on the development of the African market?

When it comes to fintech innovations for the unbanked, Africa is leading the world. The next wave of innovation in Africa is being driven by the ability of fintechs to ride on the well-established mobile money payment rails. But those fintechs need capital to grow, and investors need better information, including data to compare and evaluate the performance of these fintechs. These are precisely the challenges MIX is solving.

Additionally, while smartphones will take over in the future, feature phones are very much the reality for large segments of the African population, including small businesses. Nigeria’s smartphone penetration is still less than 20 percent and Uganda’s is in the single digits. For products to be useful today, they need to be available on feature phones.

In teaching a course on Financial Inclusion at Columbia University, which aspects of the subject do you most enjoy teaching?

It is such a privilege to work closely with the talented graduate students at Columbia’s School of International and Public Affairs. They bring unique perspectives informed by real world experiences, often from their home markets, and I am regularly inspired by their creativity and passion for solving the biggest problems. And, of course, it’s extremely gratifying to see them contributing to financial inclusion after they graduate!