Global Ventures Summit is coming to Luxembourg on November 20th -21st, and with it will come more than 40+ seasoned Silicon Valley Venture Capitalists, looking to find opportunities in the European startup ecosystem.

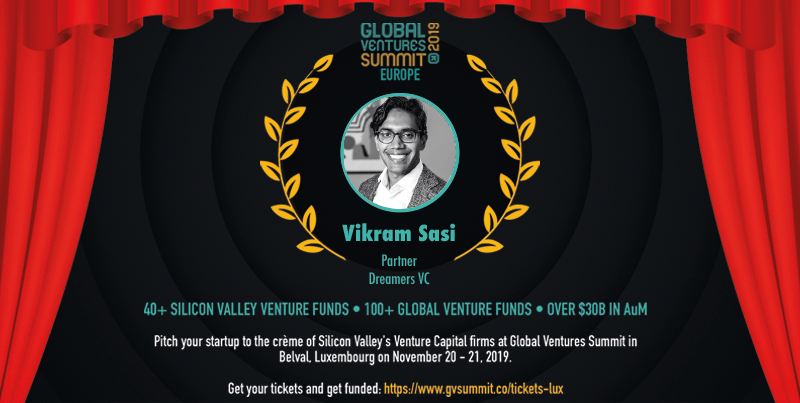

One of these investors, Vikram Sasi of Dreamers VC, sat down with Lisa Burke of RTL Today to discuss his background, Dreamers VC’s investment interests, and what he’ll be looking for in Luxembourg.

“It’s not that we need extraordinary people, but we’re looking for ordinary people that have done extraordinary things in their past.”

Can you tell us little bit about yourself, and your role as partner at Dreamers VC?

Dreamers is a 100M early stage generalist fund based here in LA. The most notable aspect is that it was founded by Will Smith, the actor, and Keisuke Honda, who is a prominent Japanese soccer player.

Despite the star power we’re actually not a traditional celebrity fund or an offshoot of the family office, we’re actually structured like a traditional venture fund and capitalised with all Japanese limited partners. So Nomura the big investment bank is our anchor LP, and we have a pretty diverse composition of the rest of our limited partners: Shiseido, Mitsubishi, ASICS, Dentsu. So it’s really allowed us to marry the Japanese corporate capital with tech startups and in the middle sits this scion of entertainment: Will Smith, and the Hollywood entertainment aspect.

You’ve spoken about macro trends in millennials related to your recent investment in Hipcamp. So when you’re thinking about trends, how do you monitor them, and how do you think about investing in them?

So when we think about trends we certainly follow all of the white papers and the market research reports that we’re getting.

We like to think at a high level; where are a lot of these things going? For instance, there’s this huge push for parents against kids screen time. So what we started seeing is that now there’s a tonne of these entertainment streaming platforms coming that are saying how do we decrease screen time while making up for the fact that we need to offer educational opportunities or tools while making sure that they also get that quality time with their parents. So that was just drilling down into one example, but ultimately we take where we think the world is going, and we try to match that with a 5-7 year timeframe from start to sort of growth capital and then getting to an exit within that time frame.

As a parent, what’s the answer to that question of screen time?

So we actually have a couple of investments in stealth, one which I actually may be able to talk about in November.

The answer is similar to Hipcamp: you have to go online to get offline. Hipcamp is the perfect example because in order to really get outdoors and be active you need to find that land, and we can unlock all sorts of private land to go camping, And so the same thing with a kids streaming platform; the last thing we want to do is be like a parent where you go out for dinner with your family and you just put the headphones on and allow them. It’s like no, there are also some interactive ways to maintain that bond between a parent and a child while also making the device just a secondary aspect.

When you think about Europe and the startups you might want to meet over here, two questions: How sort of scale are your investments, and what sort of startups are you looking to invest in?

Certainly Europe is becoming a focus for us. We’re at the tail end of deploying fund 1, and we’re about to go out and raise fund 2 where we want to take am much more global aspect because obviously Silicon Valley isn’t the only source of global innovation – especially in tech – and Europe is certainly coming up. We saw one of the recent announcements from Macron about turning Europe into a tech hub, that combined with the fact that – I don’t know how welcome this will be – but with Margaret vestiger sort of the EU leading the backlash. One of the good things that’s going to come from the backlash, which never gets mentioned, is the amount of innovation that’s going to spring up. I liken it to what happened to Microsoft in 2000 they had this huge antitrust battle. They were kneecapped, but it was more from the perspective of how it allowed a lot of other startups to start competing with them. So Europe has certainly seen it.

Obviously there are interesting things happening with Brexit, and – I don’t want to say fallout – I think there will be a ripple effect going forward. In terms of what we’re looking forward to in Luxembourg, it’s doing exactly what you all are doing which is amassing this brain-trust from all over the world and say this is a current and future tech hub. It’s very easy to overlook these things and focus on Silicon Valley, but I think there’s a lot left to be seen that we’re certainly looking forward to doing.

We’re hoping that a lot of entrepreneurs and founders hear your words of wisdom. How can they approach you, what do you want to see in their business plan, and how can they access you?

I’m happy to give my email it’s [email protected], you can go to our website and there’s a typical portal to submit your name and drop a pitch deck.

We’re an early stage investor and we specialise from seed all the way to series B. At the seed level we just have three boxes to check: Team, product and market. And oftentimes if two of them are strong enough we hope to be able to help them with the third. I wouldn’t say we have anything differentiated from what lots of other investors are looking for. To us it’s about this certain je ne sais quoi, in that there are lots of great companies that can check those boxes, but there are some that really stand out.

To us, in particular, it’s really about the founder and the founding team, and if they really think they can build this. Can they handle the inevitable challenges? Lots of startups end up pivoting, they are going to face all sorts of road blocks, and do we think they have that mental stamina and fortitude to overcome those?

There’s a reason this is the riskiest asset class, but I think it’s also the most fulfilling. Hedge funds… If you make a lot of money in the public markets, ok great – a lot of times it comes from shorting a stock. But if you really put your money where your mouth is and back a founding team with a big vision and a bold idea, and it actually comes to fruition, I think it is satisfying for everyone – and ideally for the end-user as well.

From the sound of it for you the most important thing is the team. How can they demonstrate the mental strength, to overcome roadblocks which they may not have come across yet?

It’s a good question, and I liken it to being a college admissions officer: The kids in high school have shown you all the things they’ve done, but they haven’t shown you what they are capable of. So you look for the little signals. We do a considerable amount of diligence, we talk to their references, their past bosses and employees, we look to see whether they were good managers. One thing that people forget sometimes is that as these companies grow – and you’ve seen this with the ‘Ubers’, and their missteps – they really have to grow into being incredible leaders and managers. When you’re starting off at a seed company you have 4-5 employees and you’re trying to find product-market fit, then as you grow and grow you’re going to have 100 employees, then 500, and you really grow into a different kind of executive than you were before.

It’s not that we need extraordinary people, like they were Olympians or professional stars in their own right, but we’re looking for ordinary people that have done extraordinary things in their past.

And you might be one of them, looking at your CV! How did you choose to become a venture capitalist?

I definitely had a more non-traditional path than some of my contemporaries. Prior to business school I worked abroad for about 5 years in East Africa, spent a couple of years in Haiti working for the Clinton foundation, sort of doing international development and consulting. I went to business school to expand the amount of impact I could have. Obviously I had been working with the end users and beneficiaries, but when I saw that the amount of impact that venture capital provides to the end user can honestly be kind of astonishing. A lot of it is about empathising with the end customer or consumer, and so having worked with the lowest at the bottom of the pyramid, and sort of bringing that experience up, I thought it was one of the most fulfilling jobs to use capital for impact. And you can sort of see that, int hat if you look at all of the FANG stocks, all of those were venture backed and so the amount of venture capital has about a 20x return down the line once these companies go public and make up their fair share on the stock exchanges. Thinking about if you really want to have this force multiplier impact I would argue that there’s no better way to do it than early stage financing.

Do you ever feel jealous of some of the founders that you meet, and wish you could flip your situation with theirs?

The ultimate answer is yes, because there’s no doubt that when you get to an exit you realise that they have very significant percentages of these companies, and they are going to exit with a very nice windfall. That said, they have gone through unbelievable trials and tribulations to get to that point. No one, no matter how easy it has looked or how good a face they put on, it’s such a rollercoaster. I’m pretty confident I don’t even have what it takes, and you can tell what these founders have been through.

It reminds me, one of the most prominent founders in our portfolio, Elon Musk, was giving this talk to a bunch of college students and one of them said to him “I want to be an entrepreneur, but I don’t know if it’s meant for me, so I’m making a pros and cons list”, and he said “If you even have to make a pros and cons list then you’re just not meant for it because it has to be something driving you in the back of your mind to throw caution to the wind, don’t just walk off the plank, run.” It’s immensely humbling to be around these folks, and whether or not they are successful, they went to the battlefield. I think that’s why there’s so much lore in Silicon Valley about that.

Finally, when I speak to some of the people who will be arriving here in November, you all have MBAs. How important is that to your role?

People have a love-hate relationship with MBAs in venture capital. For some it’s just a credential, they gained a lot of pre-MBA finance experience so they needed it to step up their game or go to a different fund. For me, I’d never taken a business or economics class prior to my MBA, so I like to think I got a lot more out of it than a lot of my classmates. That said it kind of provides you with a bit of a Swiss-army knife. Maybe a better analogy is that it turns you into something like an emergency room doctor: you know a little about a lot, but a lot about knowing. So it’s incumbent on your to use those skills, and to really delve into certain sectors and specialise and get into the weeds with these founders. I don’t think it’s a prerequisite by any means, but for some I look at it as a stepping stone, but you certainly don’t need one to succeed. And frankly I’m pretty sure that if you look at the most successful, the folks on the Midas list, you’ll find more folks without MBAs than those with.

Vik, thank you so much for your time!

Check out more details about Global Ventures Summit Luxembourg and register for your tickets here!

Watch the full video with Vikram here:

The Global Ventures Summit was created to connect influencers of the highest growth start-up ecosystems in the world. We enable innovative start-ups to access venture capital professionals, funded technology start-up founders, and policy makers in the freshest tech scenes on the planet. GVSummit is a business unit of Parkpine Capital.