“John, venture capital, that’s not a real job. It’s like being a real estate agent.”

Had one John Doerr heeded the admonishing words of his boss Andrew Grove while at Intel, the course of history may have been different – instead, Doerr went on to play a crucial role in many of the early tech investments that made Kleiner Perkins famous. Whereas some of these continue to be extremely high-profile ventures – cue Amazon.com – many others have since been acquired and absorbed into larger organizations, all the while making a lasting impact. Take Sybase, which “came from nowhere to become a dangerous competitor” to Oracle’s fast-growing business in the 1980s (source) by orienting its relational database system towards the emerging client/server paradigm, and which received Kleiner Perkin’s backing on little more than an early proof-of-concept and an understanding that Sybase’s offering addressed a pressing, global need:

“Sybase was pursuing an interesting idea: the need for large companies to share information across their organizations to complete accounting reports, calculate sales estimates and invoice customers, among other things. At the time, these tasks were largely manual. Sybase’s relational database management system promised to automate the sharing, updating and tracking of information across organizations. We had a strong gut instinct about the potential for the business […] In 1985, we invested in Sybase.”

Following a long business journey during which Sybase saw fierce pressure from both Oracle and Microsoft, the company was eventually acquired by SAP for $5.8bn in 2010.

SAP’s acquisition of Sybase occurred in the context of its fierce – and unabated – competition with Oracle in the enterprise database market. Image source: google finance

The road to a successful and definitive exit from an early stage VC investment can be long and tedious, and the vast majority of ventures fall by the wayside – these are probably two of the most enduring truths in VC (and in all investing). While the Pareto distribution of VC returns is likely to remain a fixture, VC is undergoing non-negligible transformations.

For some perspective, Jim Marshall of Silicon Valley Bank provides an excellent discussion around the origins of VC as we know it, explaining:

“For more than 30 years after Georges Doriot opened the first VC firm in 1946, venture capital remained essentially a craft business that barely changed. […] In this era, capital remained scarce, and technology companies — many of them making hardware — cost a lot to start. VCs had all the power and could dictate terms to entrepreneurs. Most VCs were men, and their expertise was in finance more than technology.”

At its origins, VC was an exclusive affair essentially powered by a limited number of family offices. Much later, Marshall explains, the .com boom-bust brought global visibility to tech VCs for the first time, but subsequently sucked capital out of the sector until the late 2000s, which coincides with a “distinct second wave” in VC investing:

“Capital became plentiful and entrepreneurs had choices. Andreessen Horowitz pioneered the concept of venture as a service business that could offer startups help in customer acquisition, marketing, public relations, recruiting and technical advice.”

Thus, venture capitalists became mentors as much as financiers; improved access to capital and the continued growth of the tech industry promised fertile IPO and M&A grounds and the breakneck turnover at tech startup accelerator Y Combinator epitomized the evolving environment for VC.

In parallel, a “third wave” of VC emerged on the back of the radical shift in value creation enabled by IT, leading to a bifurcation between a very limited number of large and powerful firms on the one hand, and a growing number of “micro VCs”. As a result, “power shifted hard to entrepreneurs, who could shop around for the best terms and fit”.

At present, the “democratization” of VC continues. A number of factors – such as the highly persistent low interest rate environment post-2009, now reinforced by the COVID-19 shock, alongside steady value creation in listed equity and the multiplication of private tech fortunes – contribute to the fact that “capital has completely transitioned into a commodity” and that more investments are taking place outside of the traditional tech hubs, even though these remain the undeniable epicenters of global VC. This means that “VCs are funding more companies in alternative places but are investing less in those companies compared with companies in the tech hubs”. Ultimately, the reasons for the enduring focus on the Bay Area, Boston and NYC in the U.S. context and similar hot spots across Europe and Asia are rooted in physical phenomena which “promote the growth of information in pockets”, as MIT’s Cesar Hidalgo explains in one of my “must-reads”, Why Information Grows. Knowledge and know-how are embedded first and foremost in people – giving rise to Hidalgo’s notion of the personbyte – which in turn share, perpetuate and enhance them within their social networks. A successful industrial hub is like a fire – difficult to spark if all you have are some rocks and sticks; yet all but impossible to put out once it engulfs the surrounding forest.

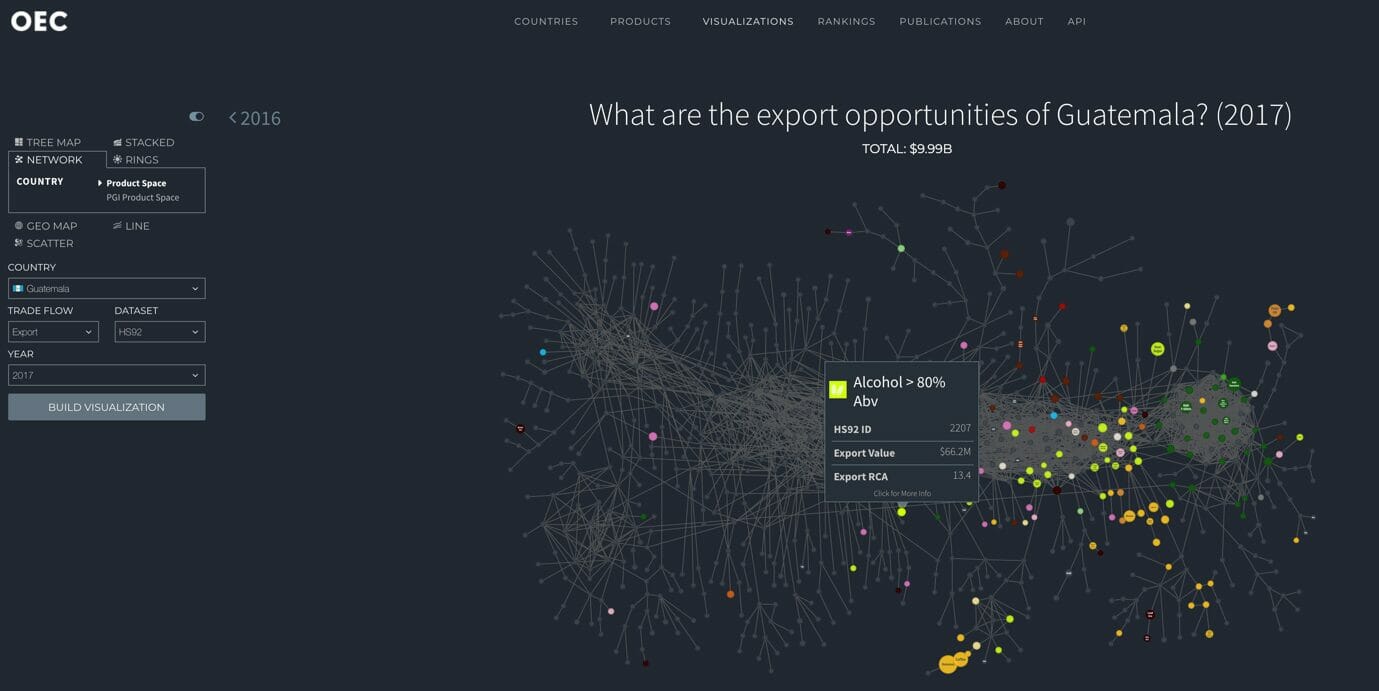

Screenshot from the Observatory of Economic Complexity visualization tool backed by Hidalgo. Trade data is but the tip of the iceberg when it comes to defining the socio-economic complexity involved in building advanced economies.

In the grand scheme of things, there are millions upon millions of young and talented people waiting to be “ignited” by that spark of entrepreneurship and industry, yet all too many lack the education and opportunity required to rise to the example of the tech luminaries that are reshaping how we live in the 21st century. How much we are willing and able to invest in talent and good ideas, no matter where they may be found, will crucially determine our ability to lift more and more people out of economic hardship and to equip communities to find their place in a fast-changing world.

The good news is that technology is making the vision of a “global village” ever more real by making incredible amounts of knowledge globally accessible, by connecting people in real time, and by providing decision makers with massive datasets and analytical support in the form of AI. This in turn helps make investment decisions more objective, more geography- and personal network-agnostic. Alex Lazarow, writing for Forbes, sees a parallel between the transition of the financial industry towards a far more technology-driven, inclusive and ultimately more intelligent modus operandi, and recent changes in VC:

“Fintech companies have upended traditional financial services by reinventing business models and offer role-models for similar product innovation in venture capital.[…]

Venture capital will similarly evolve its own business models and product lines to cater to the growing breadth of startup companies.”

And finally:

“[…] venture capital firms are realizing that there are huge growth opportunities outside of Silicon Valley. Funds are specifically being launched to target global startup ecosystems that are not the typical hubs of innovation. There are initiatives to target specific high-impact verticals like financial inclusion, education and cleantech.”

A key attribute of LHoFT is that we are tapping into the global Fintech innovation ecosystem through our community & strategic positioning, which includes supporting the “high impact verticals” outlined above. LHoFT members are poised to benefit from an increasingly convergent and connected world shaped by such things as the ongoing “democratization” and transformation of venture capital, overarching political dynamics such as the EU capital markets union project and the organic acceleration of digitization and remote work – all of which favor additional, and more diverse, investments in technology-driven ventures.

Author: Jérôme Verony – LHoFT Research and Strategy Associate